According to a recent study conducted by the Washington Post, more Americans are having trouble paying off their student loans than their home loans. At Grad Fest last week, students on campus had the opportunity to see what their monthly payments would be on their loans.

Senior Patricio Felix said he is confident he will be able to take care of his loans.

“I thought, ‘that’s like paying for a house,'” Felix said. “I know it’s a lot, but it will get paid for. I do and I don’t (feel stressed). I think as long as I have a job that I love, all will be okay.”

Senior Shelbi Fowler also attended Grad Fest, but felt unprepared once she saw how much her monthly payment will be.

“They handed me a sheet at Grad Fest that had my monthly payment for the next 10 years on it,” Fowler said. “They didn’t really prepare me for it so it was a little startling. I’m not really worried that I won’t be able to make my payments, but more concerned with how I can make larger payments to cut down on the interest.”

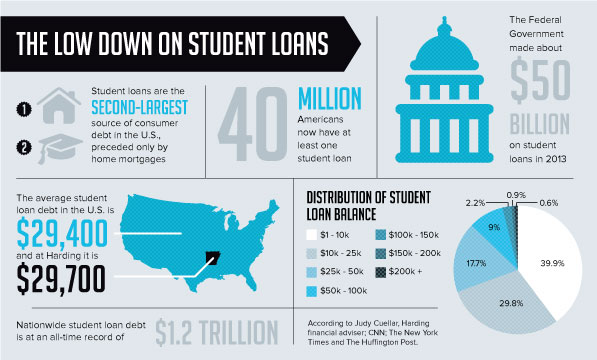

According to the Federal Reserve, the number of student borrowers rose 92 percent between 2004 and 2014. The average loan amount increased 74 percent. Student loan delinquencies rose to 11.3 percent at the end of 2014 from last year’s 11.1 percent.

For graduating seniors, these statistics may seem daunting. Students who think they may have difficulties paying off their loans can seek assistance.

According to financial adviser Judy Cuellar, most graduates struggling to pay off loans do not know that they can ask for help.

“A lot of them are afraid,” Cuellar said. “They don’t know that there is something else available. It seems so enormous that they just don’t know what to do.”

Cuellar said that there are loan forgiveness plans available for federal loans including the public service forgiveness plan, available options for payment changes and other flexible ways to deal with overwhelming or late payments.

“The most important thing is to make sure that you have a very strong understanding of what you have borrowed while in school,” Cuellar said. “Sit down and talk to a counselor about what your plan is for repayment. I invite students to come talk to a counselor any time.”

The financial aid office is open to students who would like to make an appointment to discuss payment options from Monday through Friday during business hours.