On Aug. 9, President Barack Obama signed into law a change for federal education loans, which according to Obama will help lower interest rates for student loans.

In June, Obama addressed a group of college students at the White House about the affordability and opportunities that the new interest rates would bring to American college students and to those desiring to attend college.

“This is all about the economy,” Obama said. “This is all about whether or not we are going to have the best-trained, best-educated workforce in the world. That improves our economy. And higher education cannot be a luxury reserved just for a privileged few. It’s an economic necessity for every family, and every family should be able to afford it.”

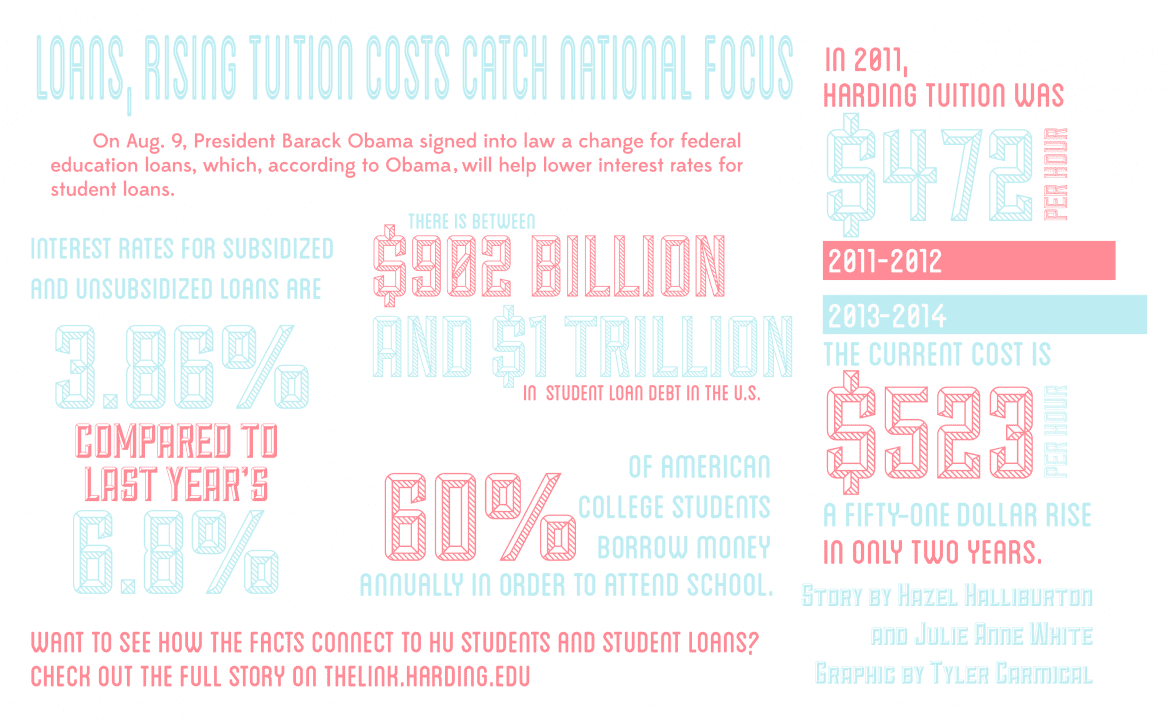

According to the Harding University financial aid office, the interest rate for a direct subsidized and unsubsidized loan for undergraduates is now at 3.86 percent compared to last year’s 6.8 percent. For graduate students it is 5.41 percent and 6.41 percent for parent and graduate PLUS loans.

In the case that student loans do increase, a cap has been put into place; not allowing interest rates to exceed 8.25 percent.

Jay Simpson, the assistant director of financial aid services, said he believes that overall the change in student loans reflects better what student loans interest rates used to be and will overall benefit the students.

“It’s the way it used to be,” Simpson said. “Now it’s fixed rates like it was; based on the treasury bill cycle.”

Simpson said that while this does benefit students now, it being based on the 91-day rate from the last treasury auction in May to the average one-year constant maturity, rates could potentially rise depending on this rate.

According to statistics concerning federal assistance on asa.com, The Chronicle of Higher Education states that 60 percent of American college students borrow money annually in order to attend school.

In the past five years, tuition prices at Harding have risen to $15,690, a 19.5 percent increase from the 2008-2009 school year when tuition was approximately $13,130. From the past 2012-2013 school year to this year alone, tuition increased by 6 percent. Due to the inflation, government aid is also increasing to combat the costs. According to Harding’s website, 90 percent of students receive some form of federal financial aid.

The Federal Reserve Bank of New York and Consumer Finance Protection Bureau estimates that there is now between $902 billion and $1 trillion in total outstanding student loan debt in the U.S.

Story by Hazel Anne Halliburton and Julie Anne White